Even in today’s digital world, writing a check remains a crucial financial skill. Whether paying rent, utilities, contractors, or giving someone a gift, understanding how to write a check correctly ensures your payment is secure, accurate, and professional.

This guide covers everything from basic definitions to advanced tips, common mistakes, and FAQs. By the end, you’ll have a complete understanding of check writing in 2025.

What is a Check?

A check is a written, dated, and signed document instructing your bank to pay a specific amount of money to a person or organization. Think of it as a paper version of an electronic transfer, giving you control over payments without handing over cash.

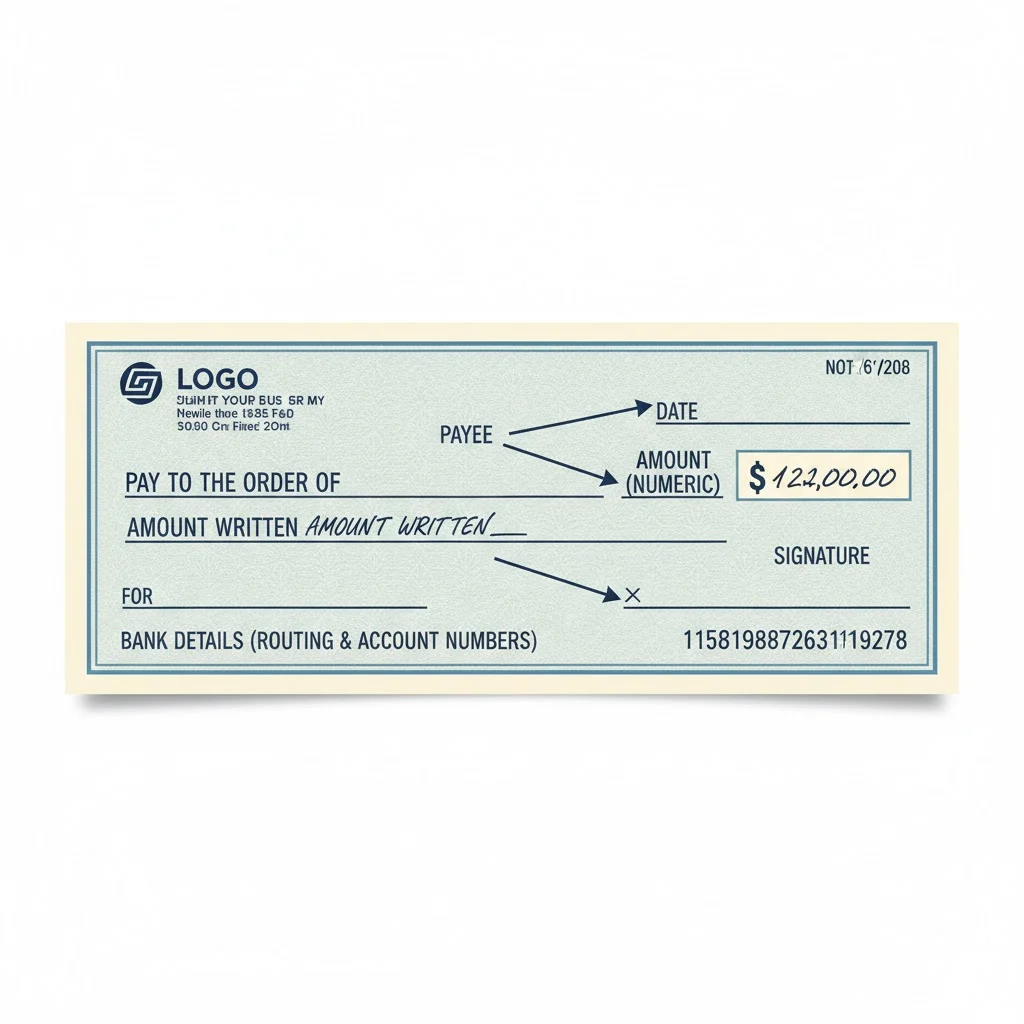

Key components include:

- Payee: The person or business receiving the money

- Date: When the check is written

- Amount: The sum written in numbers and words

- Memo Line: Optional note about the purpose of the payment

- Signature: Your authorization to release the funds

Why Learning How to Write a Check Matters in 2025

Despite the rise of online payments, checks are still widely used in 2025, particularly for:

- Rent and utility payments

- Paying contractors, tutors, or babysitters

- Gifting money or charitable donations

- Situations where digital payments aren’t accepted

Why mastering check writing matters:

- Financial literacy: Helps you understand and manage your finances

- Security: Reduces the risk of errors or fraud

- Record keeping: Provides a clear payment trail for personal and business accounting

Essential Components of a Check

Before writing a check, it’s crucial to understand its structure.

| Component | Description |

|---|---|

| Date | The day you write the check; can be today or postdated |

| Payee | The person or organization receiving the money |

| Amount (Numeric) | The payment amount written in numbers |

| Amount (Words) | The payment amount spelled out; prevents disputes |

| Memo Line | Optional note about the purpose of the payment |

| Signature | Authorizes the bank to release the funds |

| Bank Details | Your account number, routing number, and check number |

Step-by-Step Guide to Writing a Check

Writing a check correctly prevents errors and ensures your payment is processed smoothly. Follow these steps carefully.

Step 1: Write the Date

The date goes in the top-right corner of the check.

Formats:

- MM/DD/YYYY: 10/11/2025

- Month Day, Year: October 11, 2025

Tip: Use today’s date unless you are intentionally postdating the check.

Step 2: Fill in the Payee Name

Write the name of the person or company on the line that says “Pay to the order of.”

Examples:

- John Doe

- ABC Utilities

Tip: Double-check spelling to avoid rejected checks.

Step 3: Write the Amount in Numbers

In the box to the right, write the payment amount clearly.

Example:

$250.50

Tip: Start at the far left of the box to prevent tampering.

Step 4: Write the Amount in Words

Spell out the payment amount on the line below the payee name.

Example:

- Two hundred fifty and 50/100 dollars

Tip: Draw a line after the words to fill empty space.

Step 5: Fill Out the Memo Line

The memo line is optional but useful for personal records.

Examples:

- October rent

- Birthday gift

- Invoice #12345

Tip: Helps both you and the payee remember the purpose of the check.

Step 6: Sign the Check

Sign your check on the bottom-right line. This authorizes your bank to process the payment.

Tip: Always use the signature your bank has on file.

Example of a Completed Check

| Field | Example |

|---|---|

| Date | October 11, 2025 |

| Payee | John Doe |

| Amount (Numeric) | $250.50 |

| Amount (Words) | Two hundred fifty and 50/100 dollars |

| Memo | October rent |

| Signature | John A. Smith |

Common Mistakes to Avoid

- Leaving blank spaces – Could allow fraud or errors.

- Mismatch between numbers and words – Banks honor the written words over numbers.

- Unsigned checks – Invalid without a signature.

- Incorrect payee spelling – May lead to check rejection.

- Postdating without notifying – Some banks cash checks immediately.

Tips for Safe Check Writing

- Keep checks secure: Store in a locked drawer or safe.

- Use permanent ink: Prevents alterations.

- Monitor account activity: Quickly spot unauthorized transactions.

- Record checks in a register: Track spending and avoid overdrafts.

- Do not sign blank checks: Risk of fraud.

Types of Checks and When to Use Them

| Type of Check | When to Use |

|---|---|

| Personal Check | Everyday payments like rent, utilities, gifts |

| Cashier’s Check | Large payments; bank guarantees funds |

| Certified Check | Confirms sufficient funds in your account |

| Payroll Check | Employee salary payments |

| Traveler’s Check | Secure for travel instead of cash |

Digital vs. Paper Checks in 2025

Even with digital banking, paper checks remain relevant, especially for businesses or personal transactions where electronic payments aren’t possible.

Digital check advantages:

- Instant transfers

- Automatic record-keeping

- Reduced risk of lost checks

Paper check advantages:

- Tangible record of payment

- Accepted widely in traditional transactions

- No need for internet access

Tip: Use both strategically based on payment context.

How to Keep Track of Your Checks

Keeping accurate records is essential. You can:

- Use a check register: Manually log checks and balances

- Use bank apps: Track deposits, payments, and alerts

- Reconcile monthly: Match your register with bank statements

FAQs About Writing a Check

Q1: Can I postdate a check?

Yes, but inform the payee; some banks may process immediately.

Q2: How long is a check valid?

Typically 6 months, but verify with your bank.

Q3: Can I write a check without a bank account?

No, you need an account linked to the check.

Q4: What if I make a mistake on a check?

Void it and write a new one. Never erase or correct a check.

Q5: Is the memo line required?

No, but useful for record-keeping.

Q6: Can I pay a check to myself?

Yes, you can deposit it into another account.

Q7: What is a bounced check?

A check that cannot be processed due to insufficient funds.

Q8: How do I stop a check payment?

Contact your bank immediately to issue a stop payment.

Q9: What is a check register?

A log of checks written and deposits made to monitor account balance.

Q10: Are checks safe in 2025?

Yes, if properly written and monitored; combine with digital banking for extra security.

Conclusion

Knowing how to write a check remains a vital financial skill. By following this step-by-step guide, you can write checks accurately, avoid common mistakes, and maintain proper financial records. Whether paying rent, a contractor, or giving a gift, understanding checks ensures your money reaches the intended recipient securely.